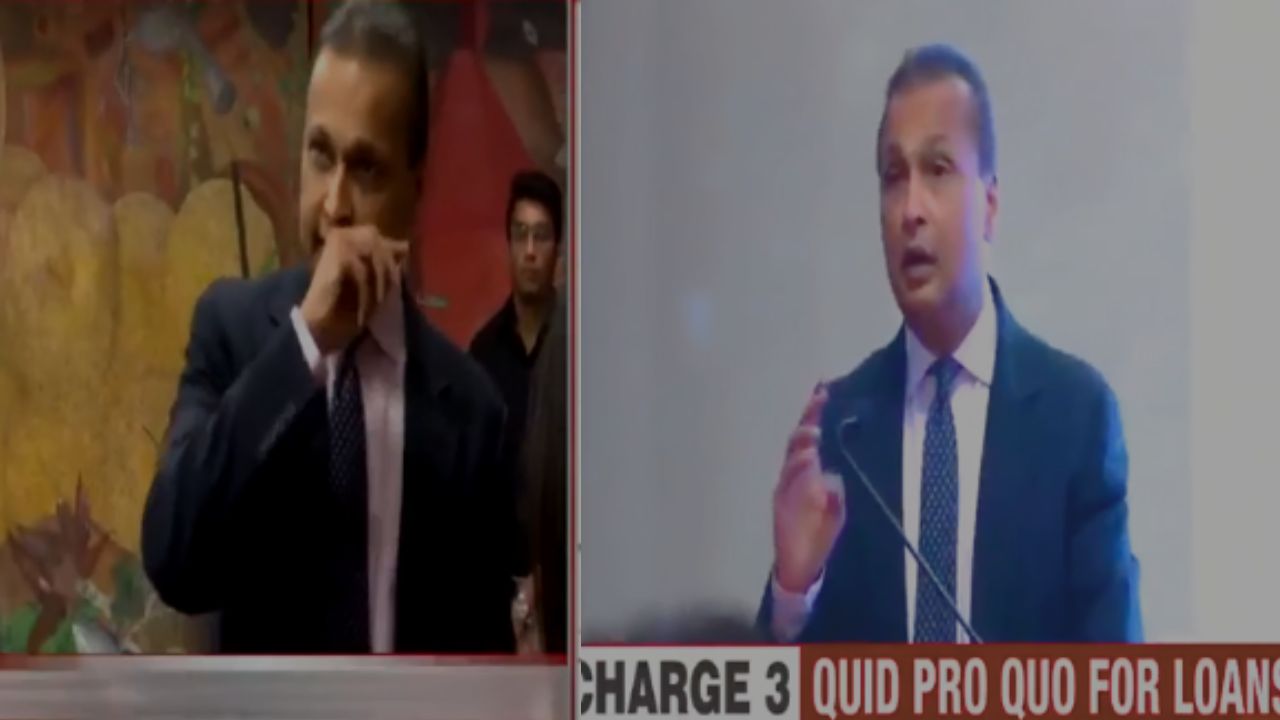

In a significant development that could have wide-ranging implications for the corporate world, industrialist Anil Ambani, former chairman of the now-defunct Reliance Communications, is set to appear before the Enforcement Directorate (ED) today in connection with a loan fraud and money laundering investigation.

The Case at a Glance

The ED’s summons stems from allegations that loans worth over ₹500 crore, taken by Anil Ambani-led companies from public sector banks, were siphoned off or misused, triggering suspicions of financial misappropriation, round-tripping of funds, and violations under the Prevention of Money Laundering Act (PMLA).

Sources indicate that the ED is probing whether shell companies and offshore entities were used to divert the loan amounts taken under the guise of business expansion and infrastructure development.

Background: How It Unfolded

The case reportedly originated from a First Information Report (FIR) filed by a consortium of public sector banks. These banks claim that Anil Ambani’s firms defaulted on multiple loan repayments, leading to massive non-performing assets (NPAs) and losses amounting to hundreds of crores.

In previous internal audits and forensic investigations commissioned by lenders, signs of fund diversion, inflated expenses, and questionable overseas transfers were discovered, prompting the ED to initiate its own inquiry.

What ED Is Investigating

The Enforcement Directorate is expected to question Anil Ambani about:

- Loan utilization patterns and discrepancies in fund usage

- Alleged links to offshore accounts and shell firms

- The role of intermediaries and financial advisors in the fund movement

- Any personal guarantees provided for the loans in question

The ED is also reportedly examining if any of the borrowed funds were used to service existing debt or finance unrelated business ventures, which would constitute a misuse of public money.

Legal Troubles Continue for the Ambani Scion

This is not the first time Anil Ambani has faced financial scrutiny. In recent years, multiple firms under his leadership, including Reliance Communications, Reliance Naval, and Reliance Infrastructure, have been under the scanner for unpaid debts and corporate mismanagement.

In 2020, the Industrialist declared in a UK court that his net worth was “zero,” in connection with a case filed by Chinese banks. This statement was widely debated, especially in the context of his earlier corporate stature and billionaire tag.

ED’s Increased Focus on Corporate Defaulters

The move to summon Anil Ambani underscores the ED’s increasing focus on high-profile defaulters and financial irregularities involving large corporate houses. In the last few years, the agency has ramped up efforts to investigate and prosecute bank frauds, economic crimes, and money laundering—especially those affecting public sector banks and involving taxpayer money.

Industry Reactions and Public Sentiment

The corporate world has reacted with cautious silence, though some financial analysts believe this signals a tightening of accountability mechanisms in India’s banking and corporate sectors.

For the general public, the case has rekindled conversations about corporate governance, the nexus between big business and banking, and the need for stronger regulatory oversight to prevent misuse of public funds.

What Lies Ahead

If found guilty of laundering or financial misappropriation, Anil Ambani could face serious consequences including seizure of assets, fines, and even imprisonment under the stringent provisions of the PMLA.

However, it’s important to note that no charges have been officially framed yet, and Anil Ambani’s appearance today is part of an ongoing inquiry. His cooperation and the data he provides could significantly influence the direction and outcome of the case.

As Anil Ambani steps into the ED office today, all eyes are on the probe agency and the evidence it uncovers. This high-stakes case not only has the potential to reshape the Ambani scion’s business legacy but also serves as a stark reminder that in today’s regulatory environment, corporate power cannot shield one from legal scrutiny.

Stay tuned for further updates as the investigation unfolds.